Bridge

Bridge

Introduction

Decentralized insurance provider Bridge Mutual has started the first-ever insurance coverage offering in one of the fastest-growing digital asset markets: stablecoins. Bridge Mutual is based on a decentralized, discretionary insurance application that allows users to insure each other and get reimbursed in the event of a market crash or an attack.

Stablecoins are not always stable. They are also susceptible to crashing and becoming potentially useless. On October 15, 2018, Tether, the market dominating stablecoin was attacked, breaking Tether’s peg to USD, dropping its value by 7%. During an attack, the market movement is massive and sudden. Assuming these attacks are legal and highly profitable, just like Soros’ attack, they will come back again and again (e.g., NuBits crash; DAI liquidity crisis). Bridge Mutual has invented a novel and transparent way of insuring stablecoins.

About

Bridge Mutual is a decentralized insurance provider that has started its first offering of insurance coverage in one of the fastest growing digital asset markets: stablecoins. Bridge Mutual is based on a decentralized and discretionary insurance application that allows users to insure each other and get reimbursed in the event of a crash or market attack. Stablecoins are not always stable. They are also prone to damage and potentially useless. On October 15 2018, Tether, the stablecoin that dominates the market came under attack, broke the Tether benchmark to USD, dropping its value by 7%. When there is an attack, the market movements are very large and sudden. Assuming this attack was legal and very profitable, like Soros' attack, it would be repeated.

Problem

Smart contracts, stable coins and other crypto products are susceptible to hackers & failures, making it difficult for institutions to enter the market.

Solution

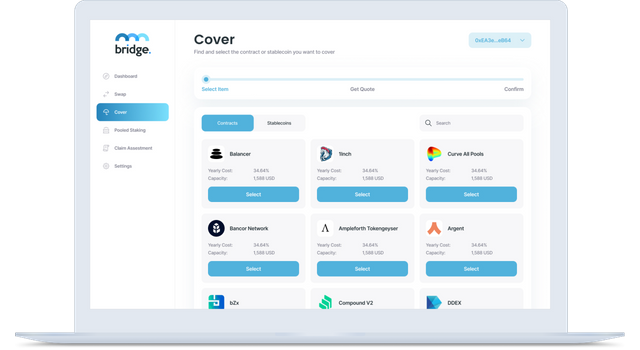

Bridge provides the most transparent and efficient p2p coverage platform, allowing anyone to reliably insure smart contracts, stable coins, and more.

#BMI #DeFi #decentralized #insurance #insuretech #stablecoins and #DAO

Fitur Bridge

- DecentralizedA decentralized and discretionary insurance application, allowing users to insure each other.

- TransparentBlockchain-based, transparent code. Both claims assessment and investment of funds are on-chain and audit-able by the public.

- FairAll claims go through a 3-phase voting process that is enforced with rewards and punishments, ensuring a thorough process for every claim.

- DisruptiveBridge will replace the traditional insurance industry, which is unfair and litigious due to its lack of transparency and misalignment of incentives.

- EfficientBridge is more efficient than traditional insurance companies, and does not require branch offices, claims specialists, or agents to work.

- QuickThe turn-around time for claims and voting is predictable and is always under 6 weeks, regardless of the size of the claim.

Bridge Covers

- Smart ContractsSecure against faulty code, bugs, hacks, and protect against permanent loss.

- Centralized ExchangesCoverage to protect against exchange hacks and attacks.

- Stable CoinsInsure against Stable Coin failure for USDT, DAI, TUSD and others.

- Future ProductsNew products including support for transaction fees, staking, and farming.

Token Utility

- DAO Voting Eligibility

- Access to coverage

- Yields from investments

- Premium profit sharing

- Vote on claims and earn

Token Metrics

- Token Ticker: $BMI

- Token Supply: 160,000,000

- Initial M/Cap: $500,000

- Sale Price: $0.125

- Vesting: 25% per Month

Token Economics

- 8%: Sales

- 41%: Liquidity

- 16%: Operations

- 6%: Vault

- 17%: Team

- 4%: Community

- 9%: Protection

Get more information, click this link

Author

Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=2851710

Komentar

Posting Komentar